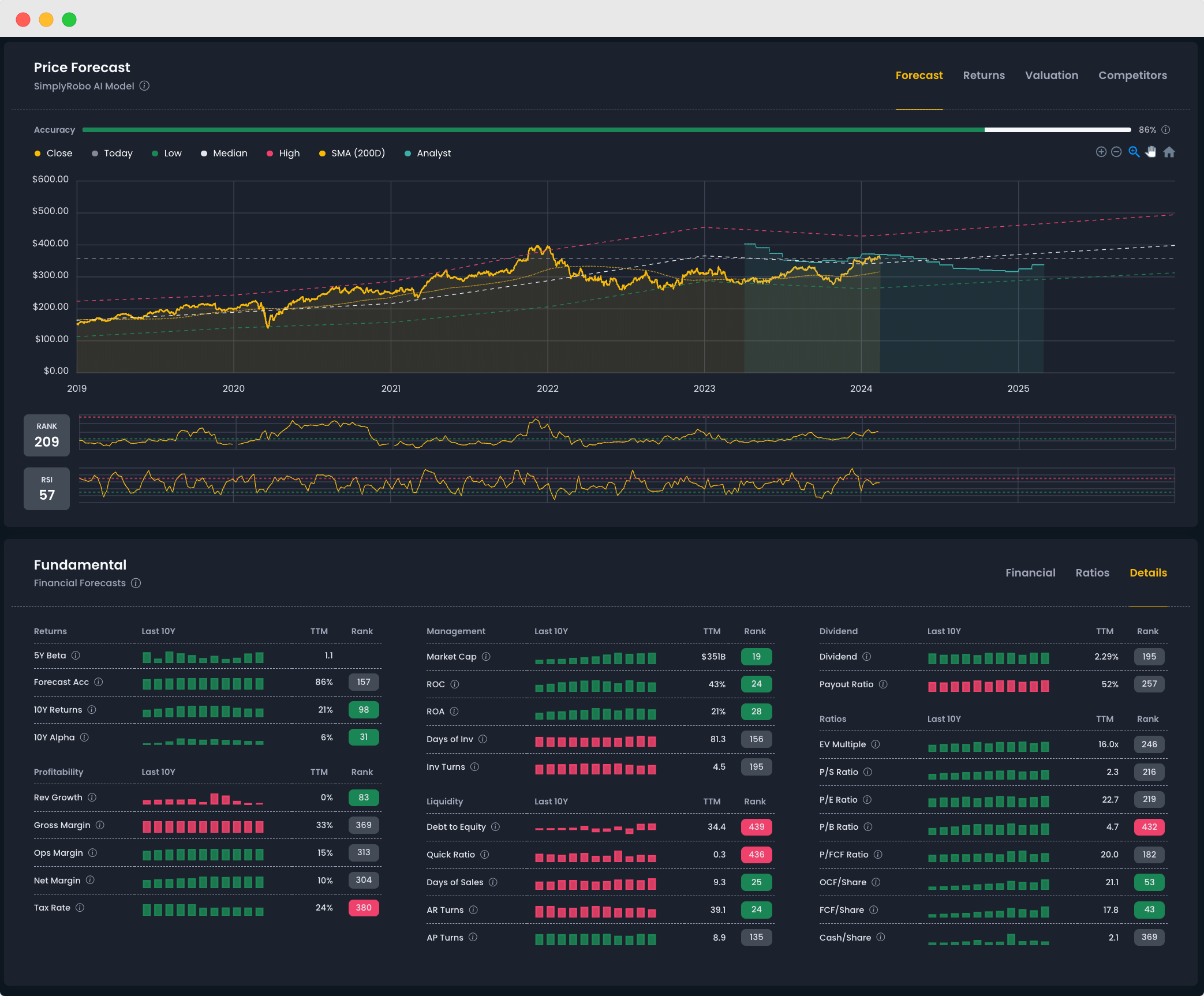

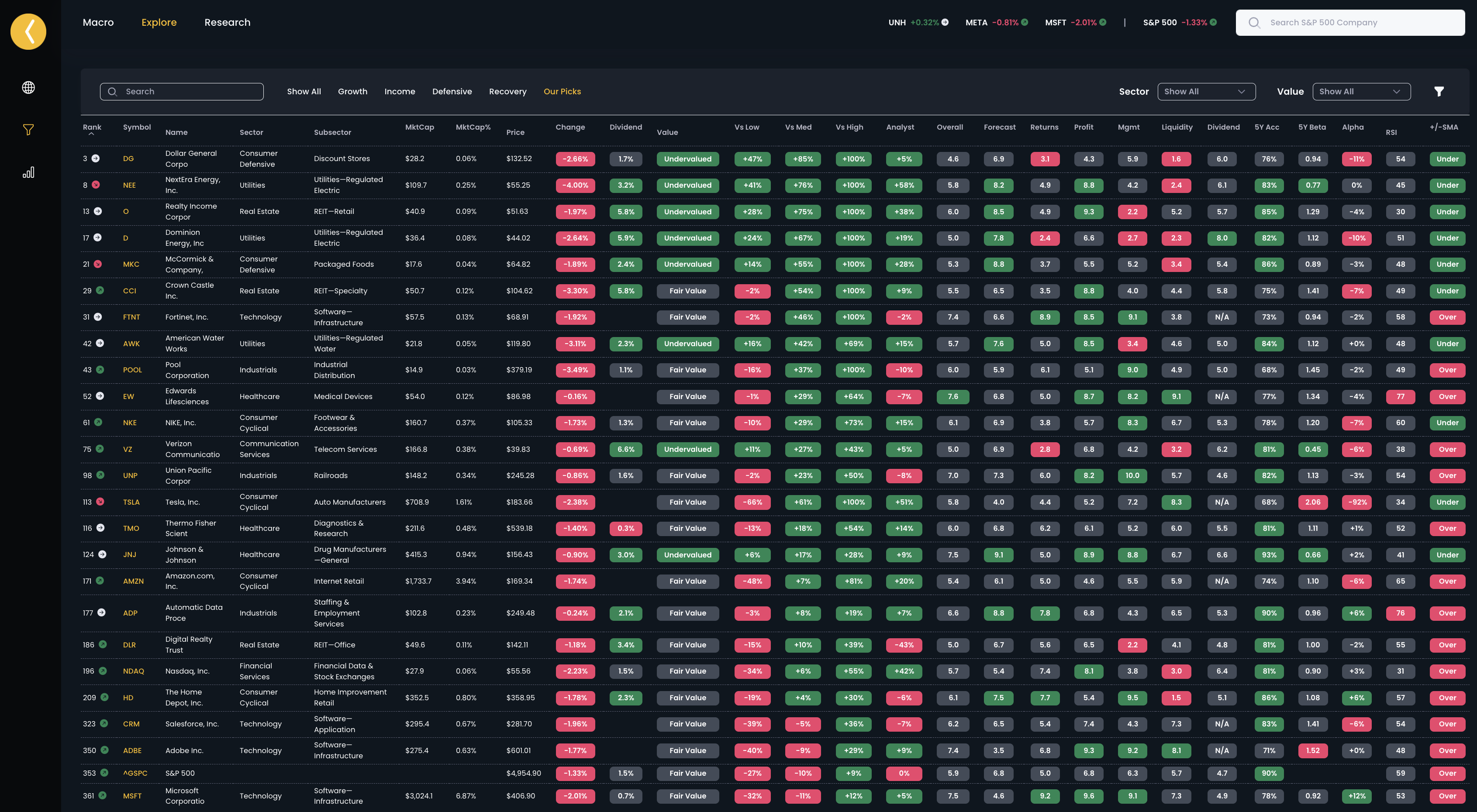

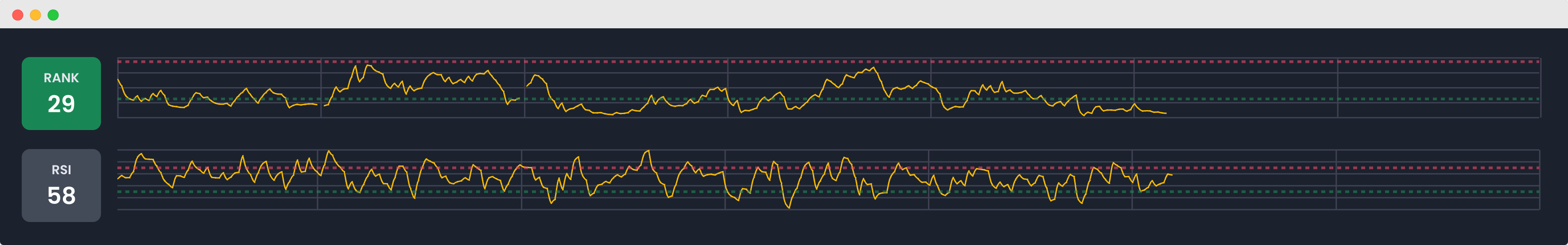

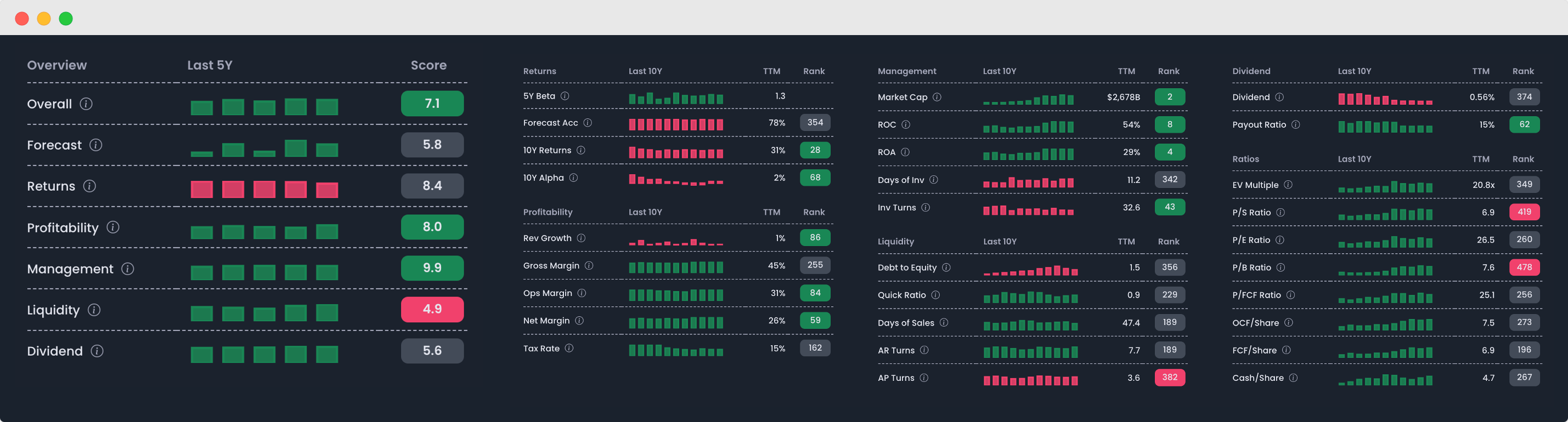

At SimplyRobo, we focus on quality, not quantity. By only analyzing companies in the S&P 500, we have developed a model that predicts market trends with greater accuracy than our competitors.

Our goal is to make the investment process as simple as possible for beginners and professionals.